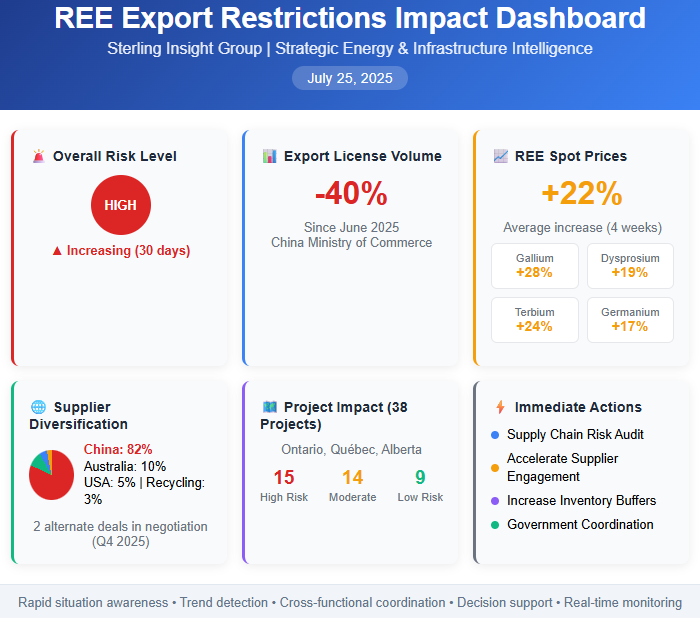

Intelligence Dashboard: REE Export Restrictions Impact

Sterling Insight Group | Strategic Energy & Infrastructure Intelligence

Date: July 25, 2025

Dashboard Purpose

Provide executives and strategic planners with a real-time, at-a-glance situational overview of the evolving rare earth element (REE) supply risk posed by Chinese export restrictions. The dashboard consolidates key indicators, risk levels, supply chain status, and actionable intelligence to support rapid assessment and decision-making.

Dashboard Components

1. Risk Level Indicator (Top-Left)

Overall Risk: 🔴 High (Severe Supply Chain Disruption Expected)

Trend: ▲ Increasing over last 30 days due to new export restrictions and price spikes

Visual:

A large red dial or gauge moving from Green (Low) → Yellow (Medium) → Red (High)

2. Export License Volume Trend (Top-Right Chart)

Data Source: China Ministry of Commerce (monthly updates)

Metric: Volume of REE export licenses issued

Status: Sharp 40% drop since June 2025

Visual:

Line graph showing a steep decline in export licenses over the past 3 months.

3. REE Spot Price Index (Center-Left)

Commodities: Gallium, Dysprosium, Terbium, Germanium

Price Movement: +22% average increase in last 4 weeks

Market: Shanghai Metals Market & London Metal Exchange

Visual:

Multi-line chart tracking prices for key REEs with price % change annotations.

4. Project Impact Heatmap (Center-Right)

Coverage: 38 Renewable Energy Projects in Ontario, Québec, Alberta

Status Categories:

Red: High risk of delay due to REE shortage

Yellow: Moderate risk; supply chain resilient but vulnerable

Green: Low risk; alternative sourcing secured

Visual:

Geographic map overlay with color-coded project markers by risk level.

5. Supplier Diversification Status (Bottom-Left)

Current Dependency:

82% China-based REE supply

10% Australia, 5% USA, 3% Recycling efforts

Alternate Supply Deals: 2 in negotiation (expected Q4 2025)

Visual:

Pie chart showing current supplier share; progress bars for negotiation status.

6. Recommended Immediate Actions (Sidebar)

Conduct Supply Chain Risk Audit — In Progress

Accelerate Alternate Supplier Engagement — Next Step

Increase Project Inventory Buffers — Planning Stage

Government Coordination for Funding — Underway

Dashboard Benefits

Rapid Situation Awareness: Clear visualization of complex metrics reduces cognitive overload.

Trend Detection: Early spotting of worsening conditions enables proactive management.

Cross-Functional Coordination: Shared platform for procurement, strategy, and leadership teams.

Decision Support: Actionable insights highlighted with status and next steps.

Scenario Monitoring: Facilitates dynamic adjustment as data updates in near real-time.